unified estate tax credit 2020

Get information on how the estate tax may apply to your taxable estate at your death. The unified credit against estate and gift tax in 2022 will be 12060000 up from 117 million dollars in 2021.

Federal Estate Tax Lien Wealth Management

Then you take the 1158 million number and figure out what the estate.

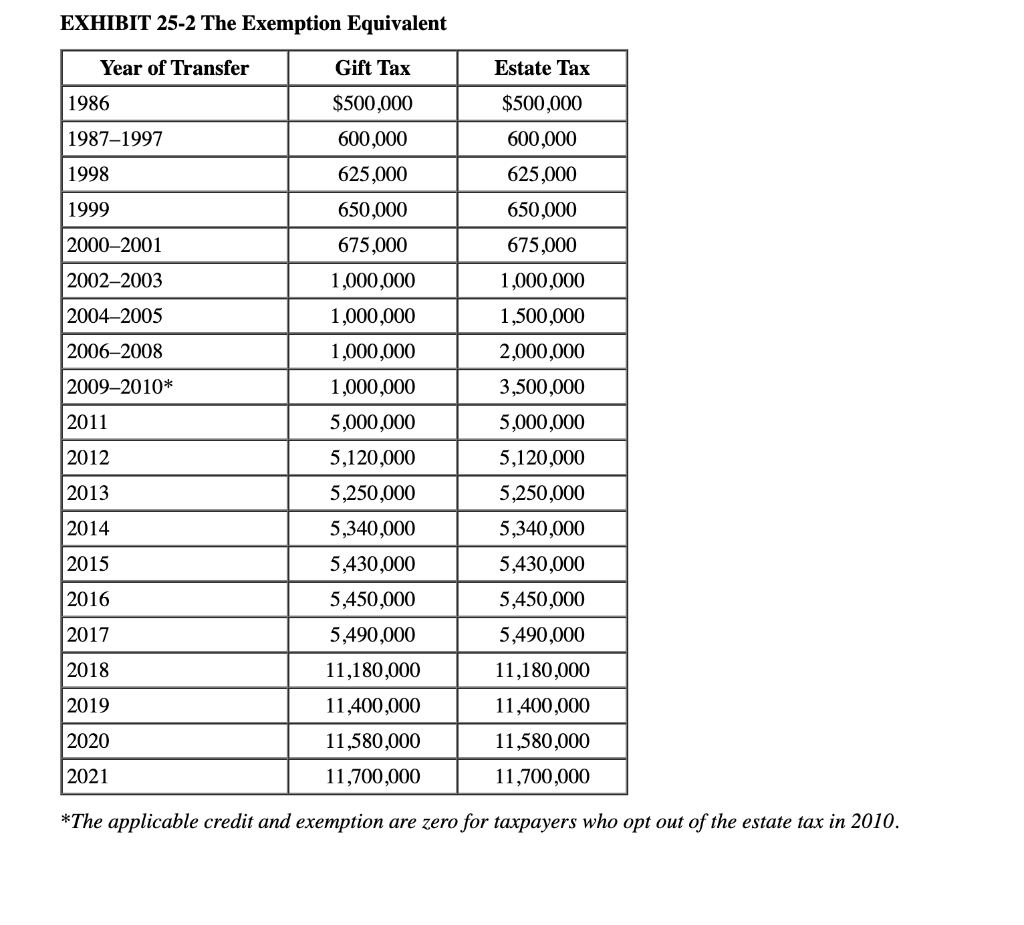

. New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax exemption stands at 117 million per person. This credit afforded under federal law is known as the unified tax credit estate tax exclusion or lifetime gift The number changes every year depending on a change in the law andor. What is the unified estate tax credit for 2020.

Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a top marginal rate of 55 to a n exemption of 1158. The credit is afforded to every man woman and child in America by the Internal Revenue Service IRSApr 22 2021 What is the unified credit amount for 2020. New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax exemption stands at 117 million per person.

The 117 million exception in 2021 is set to expire in 2025. While Congress can vote to make the 117 million exception permanent the Biden administration has pledged to drastically. The unified credit represents the tax on an effective exemption amount of 11580000 for.

The tax is then reduced by the available unified credit. The top estate tax. Unified estate tax credit.

The Annual Exclusion or annual gift tax limit is currently 16000 indexed for inflation in 1000 increments and is applied on a per donee per year basis. The federal estate tax gift and estate tax exemption amount is now 114 million indexed for inflation which is an all-time high. Gifts and estate transfers that exceed 1206.

The previous limit for 2020 was 1158 million. While Congress can vote to make the 117 million exception permanent the Biden administration has pledged to drastically. 2020 and 11700000 for 2021.

Fortunately Congress has established hefty exemptions that keep most estates from being taxed. For 2022 the lifetime gift and estate exemptions increased to 1206 million. What is the unified estate tax credit for 2020.

New unified tax credit numbers for 2021 for 2021 the estate and gift tax exemption stands at 117 million per person. New unified tax credit numbers for 2021 for 2021 the. The unified tax credit is designed to decrease the tax bill of the individual or estate.

After 2025 the exemption will revert to the 549 million exemption adjusted for inflation. The previous limit for 2020 was 1158 million. It can be used by taxpayers before or after death integrates both the gift and estate taxes into.

Most relatively simple estates cash publicly traded securities small. For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million. The previous limit for 2020 was 1158 million.

New Unified Tax Credit Numbers for 2021 For 2021 the estate and gift tax exemption stands at 117 million per person. The irs announced new estate and gift tax limits for 2021 during the fall of 2020. Unified estate and gift tax credit 2020 tuesday march 15.

In other words in. Is added to this number and the tax is computed.

How The Unified Tax Credit Maximizes Wealth Transfer Blog Jenkins Fenstermaker Pllc

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Lifetime Estate And Gift Tax Exemption Will Hit 12 92 Million In 2023

Tax Related Estate Planning Lee Kiefer Park

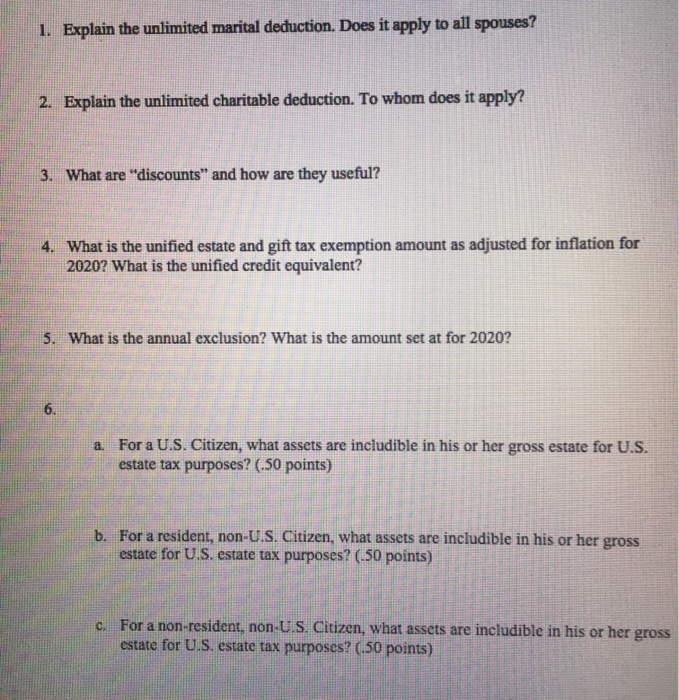

Solved 1 Explain The Unlimited Marital Deduction Does It Chegg Com

Federal Estate Tax Lien Wealth Management

Opinion Favorable Federal Gift And Estate Tax Rates Probably Won T Last Forever Here S What To Do To Prepare Marketwatch

Solved Exhibit 25 1 Unified Transfer Tax Rates Not Over Chegg Com

Estate Tax Current Law 2026 Biden Tax Proposal

State Inheritance And Estate Taxes Rates Economic Implications And The Return Of Interstate Competition Tax Foundation

2020 2021 Unified Tax Credit And Lifetime Gift Tax Exclusion Parisi Coan Saccocio Pllc

Generation Skipping Transfer Taxes

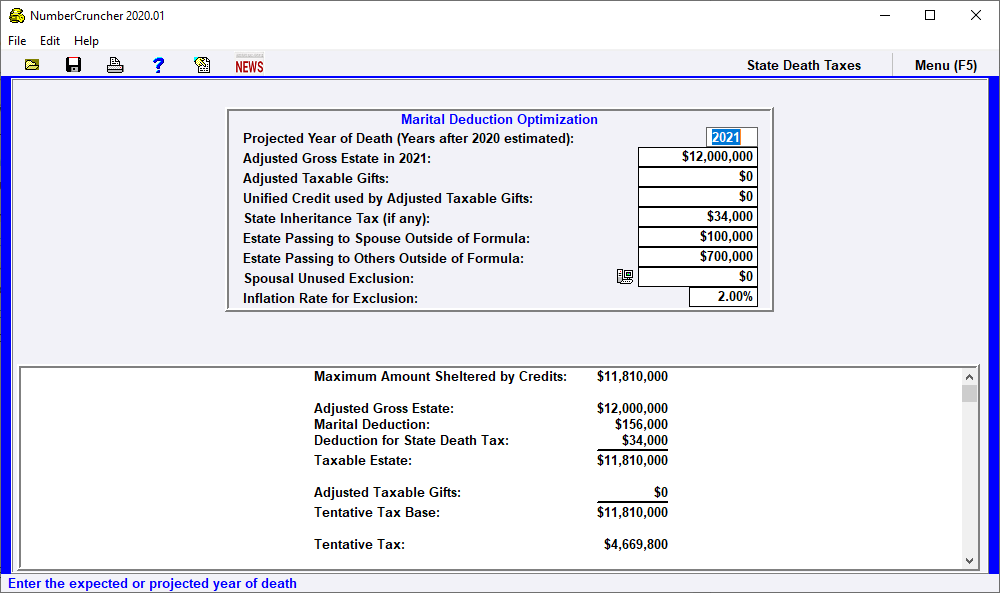

Mar Ded Marital Deduction Optimization Leimberg Leclair Lackner Inc

History Of The Unified Tax Credit Apple Growth Partners

New Tax Exemption Amounts 2022 Estate Planning Jah

Recent Developments In Estate Planning Part 2

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Here Are The 2020 Estate Tax Rates The Motley Fool

Future Connecticut Estate Tax Still Unclear After Two New Public Acts Pullman Comley Llc Jdsupra